An auto collision can be a stressful experience, but handling the aftermath doesn’t have to be. One of the most critical aspects of dealing with a collision is navigating the insurance claim process. Properly managing your claim can ensure your vehicle gets repaired quickly and correctly, and that you’re compensated fairly for your damages. In this post, we’ll go over the steps you should take immediately after an accident and provide best practices for working with insurance companies to get the best possible outcome.

Steps to Take Immediately After an Accident

Handling a car accident involves taking quick and efficient actions to ensure everyone’s safety and to document the incident for insurance purposes. Here’s what to do right after a collision:

1. Ensure Safety First

Before thinking about insurance, make sure everyone involved is safe. If possible, move your vehicle out of traffic to avoid further accidents. Turn on your hazard lights, and check for injuries. If anyone is hurt, call 911 immediately to get medical assistance.

2. Contact the Police

Even if the accident seems minor, always call the police. A police report provides an official record of the accident, which can be crucial when filing an insurance claim. The officer will gather information from both drivers, witnesses, and create a report detailing the facts of the incident.

3. Take Photos of the Scene

Before the vehicles are moved, use your phone to take pictures of the accident scene. Capture images of both vehicles, the damage, license plates, street signs, and the surrounding area. This will provide visual evidence of the damage and the location of the accident. If the other driver disputes the cause of the accident, these photos can be extremely valuable in resolving the claim.

4. Exchange Information

After ensuring safety and documenting the scene, exchange information with the other driver. This should include:

- Full names and contact information

- Insurance company names and policy numbers

- Driver’s license numbers and license plate numbers

- Make, model, and year of both vehicles involved

Make sure to also collect the contact information of any witnesses to the accident. Their statements may help in determining fault if there is any dispute.

5. Get a Copy of the Police Report

Once the police report is available, request a copy for your records. This will be needed when filing your insurance claim and during any discussions with insurance adjusters.

Filing an Insurance Claim

Once you’ve ensured everyone’s safety and collected the necessary information, it’s time to start the insurance claim process. Here’s how to handle it effectively:

1. Contact Your Insurance Company

As soon as possible after the accident, report the collision to your insurance company. Many insurance companies require you to report an accident within a specific time frame, usually 24 to 48 hours. Make sure to provide them with all the details of the accident, including the other driver’s information, police report number, and any photos or witness statements you’ve gathered.

2. Document All Damage

In addition to photos of the accident scene, take detailed photos of your vehicle’s damage from multiple angles. Keep records of any injuries you or your passengers sustained, as well as any medical bills or costs associated with the accident. Detailed documentation will help your claim go smoothly and ensure you’re compensated for all losses.

3. Get an Estimate for Repairs

Your insurance company may direct you to specific auto repair shops for estimates. However, you’re also entitled to get estimates from repair shops of your choice. In fact, it’s often a good idea to get multiple estimates to ensure the repair costs are accurate. This way, you have options if the insurance company offers less than the actual cost of repairs.

4. Work with an Adjuster

Your insurance company will assign a claims adjuster to evaluate the damage to your vehicle and determine the amount you’ll receive for repairs. The adjuster may inspect your vehicle in person or ask for photos and repair estimates from a mechanic. If you believe the adjuster’s evaluation is too low, don’t hesitate to ask for a second opinion or provide documentation to support your claim.

5. Understand Your Coverage

It’s essential to understand your insurance policy and what it covers. For example, if you have comprehensive or collision coverage, your repairs will likely be covered minus your deductible. However, if you only have liability insurance, your insurance will only cover the other driver’s damages if you were at fault. If the other driver was at fault, their insurance should cover your repairs.

Tips for Ensuring the Best Outcome for Your Claim

To make sure you receive the best outcome for your insurance claim, follow these additional tips:

1. Be Honest and Accurate

When speaking to your insurance company and the claims adjuster, be honest about the details of the accident. Don’t exaggerate or withhold any information, as this can cause delays or issues with your claim. Be as accurate and detailed as possible when explaining how the accident occurred and the extent of the damage.

2. Keep All Communication in Writing

When dealing with insurance adjusters, repair shops, or even the other driver’s insurance company, keep all communication in writing. This ensures there is a clear record of what was discussed and agreed upon. If you have a phone conversation with your insurance company, follow up with an email summarizing what was said.

3. Don’t Settle Too Quickly

If your vehicle requires significant repairs, don’t settle the claim too quickly. Make sure you understand the full extent of the damage before agreeing to any settlement offers from your insurance company. This includes damage to the frame, suspension, and any hidden issues that may not be immediately visible.

4. Seek Legal Advice if Necessary

If your claim is denied, or if the insurance company offers an amount that doesn’t cover the cost of repairs, consider seeking legal advice. An attorney who specializes in insurance claims can help negotiate a fair settlement on your behalf.

If It Ever Happens To You…

Navigating insurance claims after an auto collision can be complex, but taking the right steps immediately after an accident and knowing how to handle the claim process can significantly improve your chances of receiving the best outcome. From documenting the accident to working with claims adjusters, ensuring that every detail is accounted for can save you time, money, and hassle.

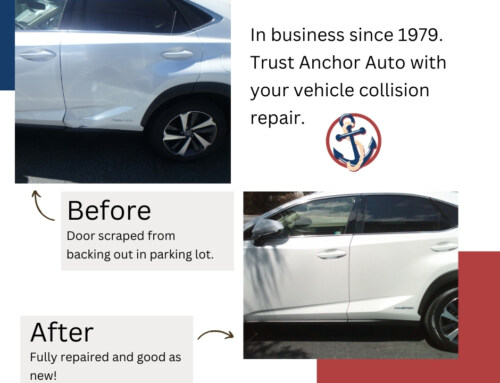

At Anchor Auto in Sunnyvale, CA, we work with all major insurance companies to help get your vehicle back on the road quickly and efficiently. With our expert repair team and commitment to customer service, you can trust us to handle all your post-collision repair needs. Contact us today to schedule an inspection and get your vehicle looking and driving like new!

Step-by-Step Guide: What to Do After an Accident

- Assess the damage: If you’ve been in a collision, first ensure your safety by checking for any visible damage to your vehicle.

- Do not assume everything is fine: Even if your car seems drivable, never assume that there isn’t underlying damage.

- Get a professional inspection: Take your vehicle to a trusted auto body shop like Anchor Auto in Sunnyvale, CA. Our trained professionals will perform a detailed post-collision inspection to uncover any hidden damage.

- Address repairs promptly: If hidden damage is found, address it as soon as possible to avoid compromising your safety or further damaging your vehicle.

Why You Shouldn’t Ignore Post-Collision Inspections

Failing to address damage after a collision can result in serious safety risks and more costly repairs down the line. For instance:

- Weakened frame: Driving with a weakened or bent frame can increase your vehicle’s vulnerability in future collisions.

- Reduced safety features: If your vehicle’s airbags or safety sensors are damaged, they may not work correctly in future accidents, putting you and your passengers at risk.

- Tire and suspension damage: Misalignment and suspension issues can lead to poor handling and increased tire wear, which could result in accidents.

Anchor Auto in Sunnyvale

We specialize in thorough post-collision inspections and repairs, ensuring your vehicle is safe and roadworthy after an accident. Whether your car has suffered minor damage and needs a bumper repair or major structural issues and auto body repair, our experienced team is here to help. Schedule your post-collision inspection with us today and drive with confidence knowing your vehicle has been expertly inspected and repaired.